News

9-18-2023. I-9 Compliance and IRCA

What Are Your Business Obligations?

Most businesses are well aware of the need to verify their employees’ eligibility to work in the United States. It is pretty well ingrained into our collective knowledge that when hiring employees it is necessary to complete the I-9 form. All too often, however, employers are failing to properly maintain a proper I-9 procedure and are finding themselves paying for their failure.

What are the obligations of a business and what are the consequences of failing to meet those obligations? Read on and you might just be surprised about how complex the law can become and how important it is to comply with the law.

What is IRCA?

The Immigration Reform and Control Act (“IRCA”) of 1986 requires employers to verify the identity and employment eligibility of all newly hired U.S. employees. Businesses are often well aware of this requirement and attempt to comply with IRCA by having each new employee complete an I-9 form. In fact, the IRCA requires the use of Form I-9 in conducting work eligibility verification.

How Difficult is It To Maintain I-9 Compliance?

Most employers approach the I-9 with the feeling that it is a simple form that shouldn’t be worried about except for the minute or two it takes to complete. I-9, however, is deceptively complex and maintaining an adequate I-9 compliance program is especially important. Although this is not the right place to fully explain a company’s obligations, if you are a business owner are you able to answer the following questions?

How long does an employer have to complete the I-9 after a person is hired? What forms are needed to complete the I-9? Does a person need a social security card to complete the I-9? What happens if a person presents a fraudulent document? What happens if the company doesn’t realize the document is fraudulent? How long must a company maintain an I-9 form? Is it necessary to maintain records of the documents? How often must a company reexamine an employee’s eligibility?

Why Does I-9 Compliance Matter?

Perhaps in the past, a company could comfortably disregard its I-9 obligations without fear of any repercussions. Those days, however, are past. The government is moving into a much more rigid culture of compliance where it is actively seeking out companies that may be disregarding its I-9 obligations. In fact, the government recently announced it would examine 1000 more U.S. employers. The number of investigations is only expected to increase.

Additionally, if the government catches a company, it is increasing imposing fines and Managers and Business owners may also be criminally liable for I-9 violations.

Updates Below:

- Edition Date

08/01/23. After Oct. 31, 2023, the prior version of Form I-9 will be obsolete and no longer valid for use.

Starting Nov. 1, 2023, employers who fail to use the 08/01/23 edition of Form I-9 may be subject to all applicable penalties under section 274A of the INA, 8 U.S.C. 1324a, as enforced by U.S. Immigration and Customs Enforcement (ICE).

You can find the edition date at the bottom of the page on the form and instructions.

Dates are listed in mm/dd/yy format.

Link attached for more information: https://www.uscis.gov/i-9

- Remote Inspection Flexibility for Form I-9 Documents has Ended

The Department of Homeland Security (DHS)/Immigration and Customs Enforcement (ICE) announced that employers will no longer be allowed to remotely inspect employees’ Form I-9.

Employers should develop plans to identify affected workers whose employment authorization documents were reviewed virtually, communicate with those workers, and prepare them to physically present their employment authorization documents, schedule in-person meetings and correct Form I-9s. Notations should be made in Section 2’s Additional Information field. If the same person performs both the remote and subsequent physical inspections for a reverification, the notation can state, “COVID-19 documents physically examined,” initial, and date. If a different person performs the physical inspection, the same notation should be made, but that person should also write their full name and title, instead of their initials. Examples of the required notations can be found here.

While ICE permits employers to fix minor technical or procedural violations, if those violations go uncorrected or are numerous, employers may be subject to civil fines, criminal penalties, debarment from government contracts, and specific court orders. Monetary penalties range from $573 to $20,130 per violation for knowingly hiring and continuing to employ unauthorized individuals to $230 to $2,292 per violation for technical or substantive issues, including failing to produce a Form I-9.

For employers who have new hires who work remotely, someone will need to examine their I-9 documents within three business days from the start of employment.

Remote Inspection Flexibility for Form I-9 Documents is Ending

The Department of Homeland Security (DHS)/Immigration and Customs Enforcement (ICE) announced that employers will no longer be allowed to remotely inspect employees’ Form I-9 as of July 31, 2023 and there will be a 30-day grace period during which employers who remotely inspected employees’ Form I-9 documents during the pandemic must re-inspect their physical documents in person by August 30, 2023.

Employers should develop plans to identify affected workers whose employment authorization documents were reviewed virtually, communicate with those workers, and prepare them to physically present their employment authorization documents, schedule in-person meetings and correct Form I-9s. Notations should be made in Section 2’s Additional Information field. If the same person performs both the remote and subsequent physical inspections for a reverification, the notation can state, “COVID-19 documents physically examined,” initial, and date. If a different person performs the physical inspection, the same notation should be made, but that person should also write their full name and title, instead of their initials. Examples of the required notations can be found here.

While ICE permits employers to fix minor technical or procedural violations, if those violations go uncorrected or are numerous, employers may be subject to civil fines, criminal penalties, debarment from government contracts, and specific court orders. Monetary penalties range from $573 to $20,130 per violation for knowingly hiring and continuing to employ unauthorized individuals to $230 to $2,292 per violation for technical or substantive issues, including failing to produce a Form I-9.

Starting July 31, 2023, for employers who have new hires who work remotely, someone will need to examine their I-9 documents within three business days from the start of employment. DHS is moving forward with the proposed rule that would authorize alternatives to the in-person inspection of I-9 documents (the Proposed Rule), which was published in August 2022. The public comment period for the Proposed Rule ended on October 17, 2022, and DHS is expected to issue a final rule sometime later this year.

1-17-2023. Manning Accounting Services is one of the premier Cannabis Dispensary Accounting Tax Firms in the United States.

1-04-2023. Have you arranged to start repaying your EIDL SBA loans?

For those who need help in setting up your repayment plan we are charging $250.00 to get it all done for you.

11-29-2022. WHAT TO DO IF AN IRS AGENT COMES KNOCKING AT YOUR DOOR

The first thing you politely say is “I would like you to deal with my accountant on this. Do you want to call him/her or should I have him/her call you?”

If pushed just say that your accountant has all your records and can answer questions that you cannot as you are not a tax savvy person. Always be polite as they control the situation. Usually they are reasonable.

Even before the COVID-19 pandemic, many individuals were surprised to find out that the IRS operates in the field. And now, after a more than two-year hiatus prompted by the pandemic, at the end of June 2022, IRS Revenue Officers resumed field visits to individual taxpayer’s homes and to business taxpayer’s offices to collect delinquent tax and secure delinquent returns. Thus, for taxpayers with significant overdue tax liabilities and multiple unfiled tax returns, there is a real likelihood of an unexpected visit from the IRS.

Naturally, for taxpayers facing such a surprise, receiving this knock on the door will result in considerable stress. Nonetheless, to paraphrase the Stoic philosopher Epictetus, the imagined anxiety may be worse than the real tax problem. Even if the role of the Revenue Officer is to collect the tax, interacting with a specific IRS employee familiar with the taxpayer’s matter provides the taxpayer with the opportunity to understand their options and begin the path towards putting their tax problems behind them.

During this initial visit, the IRS Revenue Officer will identify themselves and show the taxpayer their credentials (called the pocket commission) as well as their HSPD-12 Federal ID card. Taxpayers should call the IRS Field Employee Verification Center at 1-844-809-4566 to verify the Revenue Officer’s identity.

The Revenue Officer will ask for immediate (or part) payment of all delinquent accounts. The IRS will never ask for payment by prepaid debit cards, gift cards or wire transfers. If tax returns are delinquent, the IRS will request their immediate filing. Since most taxpayers visited in person are unlikely to be able to make a full payment, the goal of the Revenue Officer is to secure a financial statement and discuss other collection alternatives. At a minimum, the Revenue Officer will attempt to secure information about the taxpayer’s bank accounts assets, other levy sources, employment status and salary. If the taxpayer does not wish to—or is unable to speak at the time—the Revenue Officer will leave their contact information and ask the taxpayer to respond within two business days. It is important that the taxpayer responds. Otherwise, enforcement action will begin.

Conclusion

Taxpayers need to recognize that Revenue Officers wield a vast array of resolution alternatives which span the gamut from voluntary but manageable (e.g., installment agreements) to involuntary and consequential (e.g., wage garnishments and asset seizures). Although the situation is inherently stressful, taxpayers should strive to be cordial and respectful to the Revenue Officer because this initial encounter will likely establish the tone of future interactions.

Never go through this process by yourself. Even though you will have to pay your accountant to represent you it will be well worth it.

11-21-2022. Pandemic Tax Credit

If you are a business owner with W2 employees you may be eligible for Pandemic Tax Credits for 2020 and 2021 of up to $26,000 per employee. Please contact us to see if you are eligible.

11-21-2022. New Jersey Homeowners and Renters:

If you own a home or rent an apartment on October 1st 2019 you may be entitled to a cash tax credit of up to $1500 for homeowners and up to $450 for renters.

We can help you with the application process contact us at 718-227-9797

9-13-2022. Don’t Miss Out

If you haven’t filed your 2019 or 2020 Personal or Corporate returns the IRS will waive late filing penalties -up to 25% of the tax due- if the returns are filed by September 30th.

DON’T MISS OUT ON THIS!!!

Call us for help.

6-1-2022. Pandemic Unemployment Assistance

If you received the Pandemic Unemployment Assistance (PUA) during December 2020-September 2021 you should have or will possibly receive the following notice. Please read the notice carefully and send back to NYS the documents they are requiring to the fax number they give or by the address they give. This is a notice to verify your eligibility to receive the PUA. This is not a tax notice and therefore there is no need to send to our office.

4-7-2022. File On Time

ALBANY, N.Y. (NEWS10)- The New York State Department of Taxation and Finance is urging taxpayers to file on time, even if they can’t pay owed taxes in full. Filing late will result in penalties with added interest on unpaid taxes.

The Tax Department said they can help taxpayers avoid or reduce penalties and any added interest on owed taxes. “Some New Yorkers mistakenly think it’s better to simply not file their tax return if they can’t afford to pay what they owe,” said Acting Commissioner Amanda Hiller. “To avoid making their financial situation worse, they should instead file and reach out to us for ways to resolve their tax liabilities.”

The deadline to file taxes is April 18.

2-7-2022. IRS: Parents of children born in 2021 can claim stimulus as tax credit

Parents of children born in 2021 can claim a “recovery rebate credit” of up to $1,400 per child if they haven’t yet received the maximum amount of stimulus check money they are eligible for.

While there won’t be any more third-round stimulus checks distributed, parents of a child or children born in 2021 – or parents and guardians who added a new child to their family in 2021 – can still receive money by claiming it on their tax return.

In late January, the Internal Revenue Service (IRS) began issuing Letter 6475 to recipients of the third-round stimulus checks. The letter will help stimulus check recipients determine if they are entitled to and should claim the recovery rebate credit on their 2021 tax returns when they file in 2022.

The American Rescue Plan Act of 2021, which was signed into law on March 11, 2021, authorized the third round of payments to Americans. The IRS began issuing those payments on March 12, 2021.

New parents aren’t the only ones who may be eligible for the recovery rebate credit. According to the IRS, the following people may be owed stimulus check money in the form of a tax credit:

- Parents of a child born in 2021 who claim the child as a dependent on their 2021 income tax return may be eligible to receive a 2021 Recovery Rebate Credit of up to $1,400 for this child.

- All eligible parents of qualifying children born in 2021 are also encouraged to claim the child tax credit— worth up to $3,600 per child born in 2021 — on their 2021 income tax return.

- Families who added a dependent – such as a parent, a nephew or niece, or a grandchild – on their 2021 income tax return who was not listed as a dependent on their 2020 income tax return may be eligible to receive a 2021 Recovery Rebate Credit of up to $1,400 for this dependent.

- Single filers who had incomes above $80,000 in 2020 but less than this amount in 2021; married couples who filed a joint return and had incomes above $160,000 in 2020 but less than this amount in 2021; and head of household filers who had incomes above $120,000 in 2020 but less than this amount in 2021 may be eligible for a 2021 Recovery Rebate Credit of up to $1,400 per person.

- Single filers who had incomes between $75,000 and $80,000 in 2020 but had lower incomes in 2021; married couples who filed a joint return and had incomes between $150,000 and $160,000 in 2020 but had lower incomes in 2021; and head of household filers who had incomes between $112,500 and $120,000 in 2020 but had lower incomes in 2021 may be eligible for a 2021 Recovery Rebate Credit.

According to the IRS, “Get My Payment” will no longer be available as of Jan. 29, 2022, and individuals are encouraged to access their Online Account to view their first, second, and third Economic Impact Payment amounts under the related tax year tab.

The IRS is encouraging taxpayers to file electronically and choose direct deposit for the fastest way to receive their 2021 tax refund.

1-24-2022. IRS tips to get your tax refund fastest

It’s nearly that time of year again, when we cross our fingers and hope to get money back after filing our taxes – and for those owed money, the IRS has some pointers when it comes to speedy refunds.

The majority of Americans are already using direct deposit to get their refunds, but, if you aren’t, the IRS calls it the “best and fastest way to get your tax refund.”

If you’re using tax software, just select direct deposit as the refund method and enter your bank account and routing numbers. If you’re unsure where to find that information, you can look at a paper check, which will have your routing number on the bottom left and account number on the bottom right. You can also check your online back account info or call the bank for help.

If you have a prepaid debit card you may be able to send the money directly to it, but you’ll need to check with the financial institution to make sure you have the correct routing and account info.

For those taxpayers who don’t have a bank account, the IRS encourages people to visit the FDIC website, Veterans Benefits Banking Program or the National Credit Union Administration for help opening an online account.

To make the refund process even faster, file your taxes electronically and select direct deposit for the refund. The IRS says nine out of 10 refunds are issued in less than 21 days when the entire process is done electronically.

Doing so may be vital this year as it’s still unclear how the explosion of COVID-19 cases driven by the omicron variant will affect the IRS workers tasked with processing returns.

The IRS also notes that filing a complete and accurate return will help streamline the process. Taxpayers are encouraged to check IRS.gov for the latest on questions around advance payments of the Child Tax Credit, claiming a Recovery Rebate Credit for missing stimulus money and other issues.

Antsy and just can’t wait to see that larger number in your account? You can always check the progress of the refund using the IRS Where’s My Refund tool.

Tax season begins two weeks early

This year’s tax filing season will begin on Jan. 24, 17 days earlier than last year, the Internal Revenue Service announced Monday.

The IRS is warning that a resurgence of COVID-19 infections on top of less funding authorization from Congress than the Biden administration had requested could make this filing season particularly challenging.

“The pandemic continues to create challenges, but the IRS reminds people there are important steps they can take to help ensure their tax return and refund don’t face processing delays,” IRS Commissioner Chuck Rettig said.

Avoiding a paper tax return will be more than important than ever this year to avert processing delays, Rettig said. He urged taxpayers to file their returns electronically and to get their refunds by direct deposit.

It is also import for taxpayers who received a COVID-19 relief Economic Impact Payment last year or who got an advance Child Tax Credit payment to make sure they report the correct amount on their tax returns to avoid processing delays, Rettig said.

The IRS will send letters to recipients of the impact payments and the advance Child Tax Credit payments and taxpayers can also check for the amounts they received on the website IRS.gov.

The deadline for tax returns to be filed is Monday, April 18 this year, three days later than the normal April 15 deadline for filing taxes. The later date is a result of a Emancipation Holiday in the District of Columbia. By law, Washington, D.C., holidays impact tax deadlines for everyone the same way federal holidays do.

April 18 is the deadline for filing tax returns or requesting an extension. which gives taxpayers until Oct. 17 to file their returns for 2021.

10-26-2021. IRS issues information letters to Advance Child Tax Credit recipients and recipients of the third round of Economic Impact Payments; taxpayers should hold onto letters to help the 2022 Filing Season experience

WASHINGTON — The Internal Revenue Service announced today that it will issue information letters to Advance Child Tax Credit recipients starting in December and to recipients of the third round of the Economic Impact Payments at the end of January. Using this information when preparing a tax return can reduce errors and delays in processing.

The IRS urged people receiving these letters to make sure they hold onto them to assist them in preparing their 2021 federal tax returns in 2022.

Watch for advance Child Tax Credit letter

To help taxpayers reconcile and receive all of the Child Tax Credits to which they are entitled, the IRS will send Letter 6419, 2021 advance CTC, starting late December 2021 and continuing into January. The letter will include the total amount of advance Child Tax Credit payments taxpayers received in 2021 and the number of qualifying children used to calculate the advance payments. People should keep this and any other IRS letters about advance Child Tax Credit payments with their tax records.

Families who received advance payments will need to file a 2021 tax return and compare the advance Child Tax Credit payments they received in 2021 with the amount of the Child Tax Credit they can properly claim on their 2021 tax return.

The letter contains important information that can make preparing their tax returns easier. People who received the advance CTC payments can also check the amount of their payments by using the CTC Update Portal available on IRS.gov.

Eligible families who did not receive any advance Child Tax Credit payments can claim the full amount of the Child Tax Credit on their 2021 federal tax return, filed in 2022. This includes families who don’t normally need to file a tax return.

Economic Impact Payment letter can help with the Recovery Rebate Credit

The IRS will begin issuing Letter 6475, Your Third Economic Impact Payment, to EIP recipients in late January. This letter will help Economic Impact Payment recipients determine if they are entitled to and should claim the Recovery Rebate Credit on their tax year 2021 tax returns that they file in 2022.

Letter 6475 only applies to the third round of Economic Impact Payments that was issued starting in March 2021 and continued through December 2021. The third round of Economic Impact Payments, including the “plus-up” payments, were advance payments of the 2021 Recovery Rebate Credit that would be claimed on a 2021 tax return. Plus-up payments were additional payments the IRS sent to people who received a third Economic Impact Payment based on a 2019 tax return or information received from SSA, RRB or VA; or to people who may be eligible for a larger amount based on their 2020 tax return.

Most eligible people already received the payments. However, people who are missing stimulus payments should review the information to determine their eligibility and whether they need to claim a Recovery Rebate Credit for tax year 2020 or 2021.

Like the advance CTC letter, the Economic Impact Payment letters include important information that can help people quickly and accurately file their tax return.

More information about the advance Child Tax Credit, Economic Impact Payments and other COVID-19-related tax relief may be found at IRS.gov.

As the 2022 tax filing season approaches, the IRS urges people to make sure to file an accurate tax return and use electronic filing with direct deposit to avoid delays.

10-26-2021. New Billing System in Place

In an effort to streamline our business, we have purchased a state-of-the-art billing program that will allow us to automatically take our fees in an easy one-step process.

Melissa will arrange a recurring payment date. Our program will automatically email you a paid bill for your records.

We will be going online with the program starting January 1, 2022. Melissa will contact you shortly to set everything up.

Obviously, we would like to have any open bills settled by year end. If you have any questions, call Melissa or me.

Sincerely,

Lenny & Staff

6-29-2021. Child Tax Credit

2021 Child Tax Credit

6-2-2021. New Office Location

Our Office is re-opened at our NEW location, 107 Bedell Avenue, Rear Entrance. Also our phones are back up.

6-2-2021. Temporary Office Closure

Our Office and Phones will be temporarily closed due to a move to a new office space. We will notify everyone via email when the new office space is up and running. Thank you for your patience and understanding.

4-28-2021. IRS Sees Delays in Tax Refunds and Quarterly Payments

(Accounting Today) – The Internal Revenue Service is holding up millions of tax refunds for manual processing and its systems were unable to process many of the quarterly payments that needed to be sent by April 15. The IRS is holding approximately 29 million tax refunds that need to be processed manually

3-26-2021. IRS refunds will start in May for $10,200 unemployment tax break

https://www.cnbc.com/amp/2021/03/31/10200-unemployment-tax-break-irs-refunds-will-start-in-may-.html

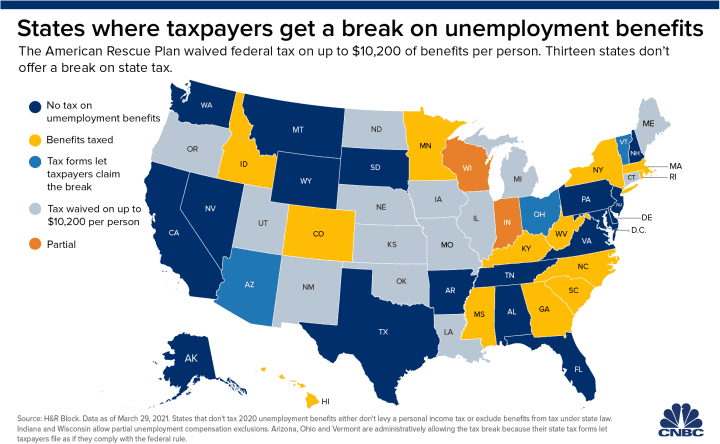

- The American Rescue Plan waived federal tax on up to $10,200 of unemployment benefits, per person, collected in 2020.

- President Joe Biden signed the $1.9 trillion Covid relief bill on March 11, after many people eligible for the tax cut had already filed their tax returns.

- The IRS will issue refunds automatically to these taxpayers starting in May, the agency said Wednesday. Those payments will continue into the summer.

The IRS will start issuing tax refunds in May to Americans who filed their returns without claiming a new break on unemployment benefits, the federal agency said Wednesday.

The American Rescue Plan waived federal tax on up to $10,200 of unemployment benefits, per person, received in 2020. Households with $150,000 or more in income are not eligible for the tax cut.

President Joe Biden signed the $1.9 trillion relief law during tax season, on March 11.

Taxpayers eligible for the tax break were left wondering if they should file amended tax returns to claim the benefit. The IRS advised taxpayers not to file an amended return, saying it was devising a workaround.

The agency confirmed Wednesday that it will issue refunds automatically to eligible taxpayers.

“Because the change occurred after some people filed their taxes, the IRS will take steps in the spring and summer to make the appropriate change to their return, which may result in a refund,” the agency said. “The first refunds are expected to be made in May and will continue into the summer.”

The IRS will conduct a recalculation in two phases for those who already filed their taxes.

The agency will start with taxpayers eligible for a break on up $10,200 of unemployment benefits. The IRS will then adjust returns for married couples filing a joint tax return, who are eligible for the tax break on up to $20,400 of benefits, and others with more complex tax returns.

Workers may still owe state tax on their benefits. More than a dozen states weren’t offering a tax break on benefits as of this week.

Around 40 million Americans collected jobless benefits last year, according to The Century Foundation. The average person got $14,000 in assistance.

The IRS is working to determine how many workers affected by the tax change already have filed their tax returns.

When to file an amended return

Taxpayers may need to file an amended return if the tax break makes them newly eligible for additional federal credits and deductions that weren’t already included on the original tax return, the IRS said.

For example, the unemployment tax break may make some people newly eligible for the Earned Income Tax Credit. Taxpayers who didn’t claim the credit on their initial return must file an amended return to get it. They may want to review their state tax returns, as well, the IRS said.

People who’d claimed a tax credit or deduction on their initial federal return but are now eligible for a larger tax break due to the unemployment waiver don’t have to file an amended return — the IRS can adjust it for them.

This is an IRS mandate and each state has the right to go along with this. New York will not give the tax break. New Jersey doesn’t tax unemployment. Check with your local state for their stance on this.

3-26-2021 Senate passes PPP deadline extension

A bill to move the Paycheck Protection Program (PPP) application deadline from March 31 to May 31 won approval in the U.S. Senate on Thursday.

The final vote to approve the PPP Extension Act of 2021, H.R. 1799, was 92–7.

There was some drama, however. A measure to amend the bill was narrowly defeated 52–48. The amendment, proposed by Sen. Marco Rubio, R-Fla., would have restricted the U.S. Small Business Administration’s (SBA’s) ability to prioritize certain PPP borrowers over others. If the measure had passed, it could have led to an amended bill having to be sent back for approval to the House of Representatives, which had passed the original bill 415–3 but currently is adjourned.

As it stands, the votes Thursday send the legislation to President Joe Biden for his signature several days before the PPP was set to expire.

The AICPA praised the passage of the PPP Extension Act, which extends the filing deadline for PPP applications by 60 days and provides an additional 30 days for the SBA to finish processing applications received by May 31.

In a news release, the AICPA said that the additional 60 days provided by the bill will greatly help small businesses, not-for-profits, and the CPAs that serve them complete existing PPP loan applications and file new ones. The extension act also provides the SBA time to address significant loan application process challenges, including confusing validation and error codes, delayed guidance, and changes to the PPP loan amount calculation for self-employed borrowers, the AICPA release said.

Patrick Kelley, associate administrator for the SBA’s Office of Capital Access, testified during a Senate Small Business Committee meeting Wednesday that 190,000 applications were still held up in the SBA’s PPP platform due to unresolved error codes related to validation checks instituted by the SBA to help prevent fraudulent applications from being funded.

The PPP Extension Act does not provide any additional funding for the current round of the PPP, which Congress provided with more than $290 billion to make forgivable loans to small businesses and not-for-profits. From the program’s opening on Jan. 11 through March 21, the SBA has approved more than 3.1 million loans totaling nearly $196 billion. In his testimony Wednesday, Kelley said that at the current lending rate, the PPP should have enough funding to last through mid-April.

3-8-2021 $1.9 Trillion Corona Relief Package

A $1.9 trillion U.S. coronavirus relief package took a step forward Saturday when the Senate voted 50–49 to approve a bill that will be sent back to the House of Representatives because the Senate changed the legislation originally approved by the House.

Known as the American Rescue Plan Act, H.R. 1319, the bill will be sent to President Joe Biden’s desk to be signed into law if it passes the House without changes. Congress is under pressure to get Biden’s signature on the bill before legislation authorizing $300 a week in federal funds added to unemployment checks expires on March 14.

The recovery rebate credits (to be paid to most taxpayers in advance as economic impact payments) would phase out more quickly than it did in the two previous rounds.

The Senate bill retains most of the tax provisions in the House bill unchanged. However, under the Senate bill eligibility for the recovery rebate credits (to be paid to most taxpayers in advance as economic impact payments) would phase out more quickly than it did in the two previous rounds.

For single taxpayers, the phaseout will begin at an adjusted gross income (AGI) of $75,000 and the credit will be completely phased out for taxpayers with an AGI over $80,000. For married taxpayers who file jointly, the phaseout will begin at an AGI of $150,000 and end at AGI of $160,000. And for heads of households, the phaseout will begin at an AGI of $112,500 and be complete at AGI of $120,000.

Under the House bill, the phaseout range was $25,000 for single taxpayers (i.e., from AGI of $75,000 to AGI of $100,000), $50,000 for joint filers, and $37,500 for heads of household.

The Senate bill also:

- Provides $300 a week in federal unemployment benefits through Sept. 6 and makes the first $10,200 in unemployment benefits tax-free in 2020 for households making less than $150,000 per year.

- Does not raise the federal minimum wage, which the House bill would have increased to $15 per hour.

- Will not include funding for a bridge to Canada in upstate New York over the St. Lawrence seaway, or the extension of a railway system near San Francisco. Funding for both projects was included in the House bill.

- Specifies that gross income does not include any amount that would otherwise be included in income due to the discharge of any student loan after Dec. 31, 2020, and before Jan. 1, 2026.

The legislation will provide funding for state, local, and Tribal governments; K-12 schools and colleges and universities; COVID-19 testing and support of the vaccine rollout; and small businesses.

1-19-2021 Congratulations to Melissa Eisler Manning

We are proud to announce that Melissa has passed her Series 6 exam and is now licensed to sell stocks , bonds, mutual funds, annuities, life insurance, health insurance, disability insurance and long term care plans. We are extremely proud of her accomplishments.

1-19-2021 Some people are inadvertently throwing away stimulus check debit cards

As if waiting for a stimulus check to arrive wasn’t frustrating enough, now it turns out some people are throwing their $600 away.

Jim Wallace almost tossed a letter he received in the mail the other day.

“I received a white envelope, with clear plastic on the top left corner and in the middle,” Wallace said.

Nowhere was a U.S. Treasury or IRS return address in Washington, D.C. that would have indicated a stimulus payment.

“There was this address here with a little seal, and it didn’t look like U.S. government mail. It looked like junk mail,” Wallace said.

No indication it contained $600 payment

He was more confused when he opened it.

“There was a card inside,” Wallace said.

A note with the card said Economic Impact Payment, which Wallace said assumed meant his stimulus. But nowhere did it say $600, so he still wasn’t sure.

“It did not look like an official IRS letter,” he said. “It did not. We almost tossed it aside. We almost threw it away.”

The IRS now acknowledges that some people are tossing the cards in the trash, or cutting them up, assuming they are an attempt to get them to sign up for something.

It is now issuing an alert to watch for the cards in the mail, as it is your real stimulus check, just not in the form of a check.

Why IRS is now using debit cards

The $1,200 checks last spring looked like typical tax refund checks from the U.S. Treasury.

But in an attempt to speed up the process this time, the IRS ordered several million pre-printed debit cards from Meta Bank. They don’t say $600, as the figure was decided at the last minute.

So, the debit cards are legit.

But Wallace and his wife, Caroline, don’t think the government should send out debit cards that come with an ATM fee for cashing it out.

“It’s got all of these fees that are associated with it,” she said, pointing to a list of $2 and $3 fees on the back. “So this sounded like a scam to us.”

But it’s not a scam — it’s your $600 stimulus.

If you accidentally threw yours away, you can request a new one by calling the IRS, if you can get through.

Or you may have to claim it on your federal income tax form.

So be careful, so you don’t waste your money.

Article first published on PIX 11 by John Matarese

1-18-2021 Tax Filing Season to start Feb 12th IRS Announces

The IRS on Friday announced that it will start accepting and processing 2020 tax returns on Friday, Feb. 12. This is later than in most previous years, when tax season has started in January. The IRS says the delay is due to the extra time it needs for programming and testing its systems following the tax law changes made by the Consolidated Appropriations Act, 2021 (CAA 2021), P.L. 116-260, which was enacted Dec. 27.

According to the IRS, much of the additional programming stems from the second round of recovery rebate credits authorized by the CAA 2021, which taxpayers can claim on their 2020 returns if they do not receive an economic impact payment.

The IRS anticipates starting to issue refunds for taxpayers who claim the earned income tax credit and/or additional child tax credit in the first week of March, for taxpayers who file electronically and provide direct deposit information and have no other issues with their returns.

1-8-2021 Stimulus Check Online Tool

Haven’t received your stimulus checks yet? Use the link below to find out about the status of your stimulus check.

https://www.irs.gov/coronavirus/get-my-payment

1-7-2021 PPP Loans Round 2

https://home.treasury.gov/system/files/136/PPP-IFR-Second-Draw-Loans.pdf

PPP2 overview

Congress revived the PPP as part of the $900 billion COVID-19 relief bill that was signed into law on Dec. 27. The program provided $525 billion in forgivable loans over five months before it stopped accepting applications in August. The Economic Aid Act rebooted PPP (or PPP2, as some call it) with many of the same parameters as the first program but also several important differences from the original PPP.

One of the biggest changes is making PPP funding available to businesses that previously received a PPP loan. Business are eligible for a second PPP loan of up to $2 million, provided they have 300 or fewer employees, have used or will use the full amount of their first PPP loan, and can show a 25% gross revenue decline in any 2020 quarter compared with the same quarter in 2019.

Fresh PPP loans also are available to first-time borrowers from the following groups:

- Businesses with 500 or fewer employees that are eligible for other SBA 7(a) loans.

- Sole proprietors, independent contractors, and eligible self-employed individuals.

- Not-for-profits, including churches.

- Accommodation and food services operations (those with North American Industry Classification System (NAICS) codes starting with 72) with fewer than 300 employees per physical location.

The legislation also allows borrowers that returned all or part of a previous PPP loan to reapply for the maximum amount available to them.

PPP loan terms

As with PPP1, the costs eligible for loan forgiveness in PPP2 include payroll, rent, covered mortgage interest, and utilities. PPP2 also makes the following potentially forgivable:

- Covered worker protection and facility modification expenditures, including personal protective equipment, to comply with COVID-19 federal health and safety guidelines.

- Expenditures to suppliers that are essential at the time of purchase to the recipient’s current operations.

- Covered operating costs such as software and cloud computing services and accounting needs.

To be eligible for full loan forgiveness, PPP borrowers will have to spend no less than 60% of the funds on payroll over a covered period of either eight or 24 weeks — the same parameters PPP1 had when it stopped accepting applications in August.

PPP borrowers may receive a loan amount of up to 2.5 times their average monthly payroll costs in the year prior to the loan or the calendar year, the same as with PPP1, but the maximum loan amount has been cut from $10 million in the first round to the previously mentioned $2 million maximum. PPP borrowers with NAICS codes starting with 72 (hotels and restaurants) can get up to 3.5 times their average monthly payroll costs, again subject to a $2 million maximum.

Simplified application and other terms of note

The new COVID-19 relief bill also:

- Creates a simplified forgiveness application process for loans of $150,000 or less. Specifically, a borrower shall receive forgiveness if the borrower signs and submits to the lender a certification that is not more than one page in length, includes a description of the number of employees the borrower was able to retain because of the loan, the estimated total amount of the loan spent on payroll costs, and the total loan amount. The SBA must create the simplified application form within 24 days of the bill’s enactment and may not require additional materials unless necessary to substantiate revenue loss requirements or satisfy relevant statutory or regulatory requirements. Borrowers are required to retain relevant records related to employment for four years and other records for three years, as the SBA may review and audit these loans to check for fraud.

- Repeals the requirement that PPP borrowers deduct the amount of any Economic Injury Disaster Loan advance from their PPP forgiveness amount.

- Includes set-asides to support first- and second-time PPP borrowers with 10 or fewer employees, first-time PPP borrowers that have recently been made eligible, and for loans made by community lenders.

12-21-2020 Stimulus Package December 2020

Congress has hammered out a new Covid-19 stimulus package that includes a new round of Paycheck Protection Program loans, tax relief and other measures for small businesses.

Congress appears set to vote on the relief measures as early as Monday after leadership from both parties endorsed the new deal. Congress will ultimately pair the deal with additional legislation to fund the government for the next fiscal year. Lawmakers have repeatedly passed short-term measures to keep the government operating over the last few weeks while lawmakers hammer out a stimulus deal. It must still pass the new legislation for any of its provisions to become law.

The roughly $900 billion spending measure will include Stimulus checks of $600 per individual, an extended eviction moratorium and enhanced unemployment insurance of about $300 a week, according to a summary released by House Republicans, among a variety of school funding, vaccine and other public health-related measures.

The package also comes with a variety of measures long sought after by the business community, including:

- A new round of PPP loans, with about $284 billion earmarked for the program. It also comes with expanded eligibility for so-called 501(c)(6) nonprofits, such as local chambers of commerce, which were left out of the original program. Businesses with “severe” revenue reductions can apply for a second loan.

- Expenses paid for with PPP loans would be considered tax deductible, officially reversing an IRS decision made earlier in the year that would have seen some small businesses pay more in taxes. The ability to deduct expenses if paid for with PPP loans had been the focus of intense lobbying by small business groups.

- A fresh $20 billion for the Economic Injury Disaster Loan Program.

10-26-2020 Key Tax Law Changes 2020

10-26-2020 PPP Loan Forgiveness

On Thursday, Oct. 8, 2020, the Small Business Administration released PPP Loan Forgiveness Application Form 3508S, which is available for borrowers meeting criteria listed on the top of the application. When you are invited to apply, you will use the new streamlined form (form 3508S) if you received a PPP loan of $50,000 or less and have not, together with your affiliates, received PPP loans totaling $2MM or more.

10-6-2020 Economic Impact Payment

The Internal Revenue Service announced today that the deadline to register for an Economic Impact Payment (EIP) is now November 21, 2020. This new date will provide an additional five weeks beyond the original deadline.

The IRS urges people who don’t typically file a tax return – and haven’t received an Economic Impact Payment – to register as quickly as possible using the Non-Filers: Enter Info Here tool on IRS.gov. The tool will not be available after November 21.

“We took this step to provide more time for those who have not yet received a payment to register to get their money, including those in low-income and underserved communities,” said IRS Commissioner Chuck Rettig. “The IRS is deeply involved in processing and programming that overlaps filing seasons. Any further extension beyond November would adversely impact our work on the 2020 and 2021 filing seasons. The Non-Filers portal has been available since the spring and has been used successfully by many millions of Americans.”

Special note: This additional time into November is solely for those who have not received their EIP and don’t normally file a tax return. For taxpayers who requested an extension of time to file their 2019 tax return, that deadline date remains October 15.

To support the ongoing EIP effort, many partner groups have been working with the IRS, helping translate and making available in 35 languages IRS information and resources on Economic Impact Payments.

To help spread the word, the IRS sent nearly 9 million letters in September to people who may be eligible for the $1,200 Economic Impact Payments but don’t normally file a tax return. This push encourages people to use the Non-Filers tool on IRS.gov.

“Time is running out for those who don’t normally file a tax return to get their payments,” Rettig added. “Registration is quick and easy, and we urge everyone to share this information to reach as many people before the deadline.”

While most eligible U.S. taxpayers have automatically received their Economic Impact Payment, others who don’t have a filing obligation need to use the Non-Filers tool to register with the IRS to get their money. Typically, this includes people who receive little or no income.

The Non-Filers tool is secure and is based on Free File Fillable Forms, part of the Free File Alliance’s offering of free products on IRS.gov.

The Non-Filers tool is designed for people with incomes typically below $24,400 for married couples, and $12,200 for singles who could not be claimed as a dependent by someone else. This includes couples and individuals who are experiencing homelessness.

Anyone using the Non-Filers tool can speed the arrival of their payment by choosing to receive it by direct deposit. Those not choosing this option will get a check.

Beginning two weeks after they register, people can track the status of their payment using the Get My Payment tool, available only on IRS.gov.

9-17-2020 Federal Unemployment Starting Up

9-11-2020 Additional Federal Unemployment

Federal additional $300/week unemployment benefits for New Yorkers will start next week. There will be 6 weeks of benefits starting retroactively to August 01, 2020.

9-1-2020 Still haven’t applied for your SBA EIDL Loan?

8-27-2020 A common question we hear is How Much Life Insurance Should I Have? The answer is how much can you afford?

Rule of thumb is that you should have enough life insurance to cover your outstanding debt such as mortgages, credit cards, car loans, boat loans etc. Then enough to cover 4-5 years of income. Finally add in funeral expenses.

You want to leave your spouse debt free. If nothing else that is your minimum. Then considering your position in life determines the amount over that. If you have children in the house then obviously you will need more. Providing a college fund is important with the ridiculous amounts college costs now let alone 10-15 years from now. If your kids are out of the house then you want to make sure your spouse has enough to not have to significantly lower their lifestyle.

If you are a one income family don’t think you should have insurance only the breadwinner. It will cost you to hire people to replace and do what they provide.

The next question is once we know how much we need what kind of insurance do we get and how can we afford it?

The two basic types of insurance are Whole Life and Term.

Term is insurance for a specific term of time. It is meant to give you as much coverage as possible as cheap as possible. You don’t use it you get nothing back like car insurance.

Whole Life is insurance that builds cash value that will always be there if you decide you don’t want insurance anymore or if you don’t want as much. Paying off a mortgage, children growing up and leaving the house (They truly never leave don’t kid yourself) or a change of lifestyle (like retiring) may alter your needs. With Whole Life there will be a point that you will have more money in the policy than you spent on it. Because of that savings feature it is more expensive than term.

Both types serve the same primary purpose. Protect your spouse and family. If your spouse never needs to collect on the policy then Whole Life will make a nice nest egg that you can use for retirement.

If you want to get more information or have a customized plan drawn up for you call Melissa in our office. She will gladly give you help and pricing.

8-26-2020 When am I going to get the extra unemployment benefit?

Thirty states were approved for the assistance as of Monday evening.

(They are: Alabama, Alaska, Arizona, California, Colorado, Connecticut, Georgia, Idaho, Indiana, Iowa, Kentucky, Louisiana, Maryland, Massachusetts, Michigan, Mississippi, Missouri, Montana, New Hampshire, New Mexico, New York, North Carolina, Oklahoma, Pennsylvania, Rhode Island, Tennessee, Texas, Utah, Vermont and Washington state.)

States are getting an initial tranche of lost-wages funding covering three weeks, going back to the week ended Aug. 1.

States may pay additional weeks depending on how quickly the earmarked federal funds (up to $44 billion) are depleted.

Officials from the Labor Department and Federal Emergency Management Agency, which is overseeing the program, estimate states will get about five total weeks of funding.

But workers may not see the money show up in their accounts for several weeks, as states build out the infrastructure to administer the payments.

8-17-2020 EIDL and the pandemic

Many businesses have used EIDL loans administered by the SBA to offset the pandemic’s effects. An EIDL is a low-interest, fixed-rate loan that can provide assistance to small businesses during an emergency.

EIDL loans are not forgivable, but the 30-year term provides payback flexibility to borrowers. In response to the pandemic, Congress also created $20 billion in EIDL advance grants that are not required to be repaid. Eligible applicants who applied for an EIDL were permitted to request up to $10,000 in EIDL funding to be immediately disbursed, and this advance grant amount did not need to be repaid, regardless of the loan decision.

The $20 billion in advance grants has been exhausted.

8-17-2020 UNEMPLOYMENT

8-17-2020 A revamped PPP coronavirus loan program is in the works. Will it help small businesses left out before?

The Paycheck Protection Program stood out as an early success of the government’s pandemic relief effort, but it ended with a whimper and left billions of dollars unallocated when small businesses got spooked by the ever-changing rules.

Even as Democrats and Republicans fight over other aspects of another major stimulus bill, they have largely agreed on how to revamp the PPP to restore its popularity and usefulness.

But groups representing the smallest business owners — independent contractors, the self-employed and minority-owned businesses who complained they were largely shut out of the earlier rounds of funding and for whom these changes are meant to help — are already questioning whether it will be enough.

For starters, they note that both the old and the proposed new PPP are run by the Small Business Administration, which works with businesses with as many as 500 workers, has less experience with companies with fewer than 100, and almost none with those with one or a handful of employees.

The bulk of America’s small businesses have fewer than 20 employees, but they didn’t get the bulk of the earlier PPP money and aren’t sure they’ll do better under a revised program still run by the SBA, advocates say.

For small businesses that already received one of the forgivable PPP loans, there is some good news about a possible PPP relaunch: They may be able to get a second loan, something not permitted in the original rules. That could be a lifeline for businesses that burned through the initial 24 weeks of payroll support.

In total, more than 5.1 million businesses got PPP funds before lending ended Aug. 8. The government says 51 million jobs were saved. S&P Global estimates it is closer to 13.6 million.

When the program began, $349 billion flowed out the door in less than two weeks. But the early successes were soon replaced by outrage and confusion. The public was frustrated to hear of large publicly traded companies like Potbelly or Shake Shack receiving loans.

Commercial banks tasked with distributing the money gave priority to their existing customers, leaving small businesses without a strong banking relationship scrambling to compile the needed application paperwork as the money flowed to larger businesses.

Meanwhile, rules governing how the money could be spent changed weekly, at times daily, casting doubt on what terms businesses would have to meet to have the loans forgiven. Demand plummeted. Even an extension of the program in June wasn’t enough to renew interest. While more small loans were processed in the second round than in the first, more than $126 billion was left on the table when the program ended.

Republicans want to target businesses with fewer than 300 employees that have seen sales decline by 35% or more, and to set aside $10 billion for community and rural banks to lend. Democrats want to focus on those with fewer than 100 employees that have seen sales decline by 50% or more. Both want to set aside up to $25 billion for businesses with fewer than 10 employees.

For the nation’s smallest businesses — many of which are Black-owned and have no employees — even the changes Congress is proposing may not be enough, said Ron Busby Sr., president of U.S. Black Chambers.

An estimated 41% of Black-owned businesses have permanently closed since the pandemic began, he said.

More info to follow as it happens.

7-24-2020 PPP Loan Guidance

- Please make sure your online profile for your bank is active.

- Have you spent all of your funds that are eligible for forgiveness?

- Have you reviewed the PPP forgiveness program details available at SBA.gov and treasury.gov ?

- Will you be using the Covered Period or the Alternative Payroll Covered Period for your payroll costs?

- Will you be using the 8 week or the 24 week covered period?

- Do you meet any of the Safe Harbor requirements?

- Have you determined if you are eligible to use the simpler 3508 EZ form?

- If you are eligible to use the 3508 EZ form, have you completed it and calculated your payroll costs by using Tables 1 & 2 from the Schedule A worksheet within form 3508?

- If you are not eligible to use the 3508 EZ form, have you completed Form 3508 including the forgiveness calculation form, Schedule A and the Schedule A worksheet?

- Have you calculated your payroll costs?

- Do you have the documentation to support your payroll costs, including wages, health care costs, retirement costs and taxes?

- Do you have the documentation to support your non-payroll costs, including eligible utilities, rent and mortgage interest?

- Please have handy your EIDL advance amount, if you received one, and application number.

- If you are not ready with any/all of the above, when can you be ready?

7-24-2020 New Stimulus Package Expected Monday—$1,200 Second Stimulus Checks, Unemployment Benefits Propose

$1,200 Stimulus Check

Treasury Secretary Steven Mnuchin confirmed earlier today that a stimulus check would make it into the next bill:

It will match the stimulus check created by the Cares Act, which created a refundable tax credit of $1,200 to qualifying Americans who earned less than $75,000. It added an extra $500 for dependent children ages 16 and younger. Joint filers would get $2,400 for those who earned less than $150,000.

If you earn more than those limits, your stimulus check amounts would be reduced by 5% of your adjusted gross income above those limits.

Lower Unemployment Benefits

We have no concrete information about the next round of unemployment benefits but Secretary Mnuchin has said that he hopes to adjust it to 70% of wages.

Information in this post comes from Forbes.com

7-10-2020 The IRS on Wednesday issued the limitations on depreciation deductions for passenger automobiles first placed in service in 2020 and the amounts of income inclusion for lessees of passenger automobiles first leased during 2020 (Rev. Proc. 2020-37). For these purposes, passenger automobiles include trucks and vans. The amounts in the revenue procedure are inflation-adjusted as required by Sec. 280F(d)(7), using the automobile component of the chained consumer price index for all urban consumers (C-CPI-U).

For passenger automobiles to which the Sec. 168(k) additional (bonus) first-year depreciation deduction applies and that are acquired after Sept. 27, 2017, and placed in service during calendar year 2020, the depreciation limit under Sec. 280F(d)(7) is $18,100 for the first tax year; $16,100 for the second tax year; $9,700 for the third tax year; and $5,760 for each succeeding year, all unchanged from 2019. Under Sec. 168(k)(8)(D)(i), no bonus depreciation is allowed for property acquired before Sept. 28, 2017, and placed in service after 2019.

For passenger automobiles placed in service in 2020 for which no Sec. 168(k) additional (bonus) first-year depreciation deduction applies, the depreciation limit under Sec. 280F(d)(7) is $10,100 for the first tax year; $16,100 for the second tax year; $9,700 for the third tax year; and $5,760 for each succeeding year, also unchanged from 2019.

7-9-2020 PPP Loans Extension

On June 30th, the US Senate voted unanimously to extend the Paycheck Protection Program through August 8th, 2020. That is a 5-week extension to the program. You can read the full article on the PPP Extension here.

If you haven’t yet applied for the program, you can download a PPP application here and submit it to a lender.

7-2-2020 Big News As IRS Opens Taxpayer Phone Lines & More

The Internal Revenue Service (IRS) continues to resume operations.

According to the IRS Commissioner, as of mid-month, thousands of employees had returned to facilities in seven states (Kentucky, Texas, Utah, Georgia, Minnesota, Tennessee, and Missouri) with employees in four more states and Puerto Rico returning on June 29. The IRS will reopen facilities in remaining states on July 13. And, as you can imagine, the IRS is putting an emphasis on telework and plans to continue to encourage it, where possible, for the foreseeable future to ensure social distancing.

Here’s a closer look at some of what’s open or opening soon:

Telephone Lines. Automated phone lines are available to handle calls. But the big news is this: all IRS toll-free phone lines supported by customer service representatives for taxpayers and tax professionals are also now available. You should expect to wait, however, due to limited staffing.

If you’re looking for an update for your regular tax refund, you can call the automated number at 800.829.1954. And before you dial: this line has no information about the status of your stimulus checks (Economic Impact Payments). For those, call 800.919.9835.

Balance Due Notices. The IRS was unable to mail some previously printed balance due notices as a result of office closures. These notices will be delivered to taxpayers in the next few weeks. Some of the notices will have due dates that have already passed. However, each notice will include an insert confirming that the due dates printed on the notices have been extended. I can confirm that the inserts are going out (several of my clients have received them)

7-1-2020 The SBA’s Economic Injury Disaster Loan (EIDL) is a special loan backed by the government that offers an unusually low interest rate.

And because it’s a government loan with unusual benefits, the government needs to know that the funds are being spent in the right way. Which means your EIDL loan comes with bookkeeping and record keeping requirements you might not be aware of.

One section of the EIDL agreement, “Books and Records”, outlines your bookkeeping and record keeping responsibilities, such as maintaining accurate books. We are telling all our clients to open up a separate bank account strictly for this. That way when the SBA asks for records and financials we can easily draw the information for that.

Here are some of the conditions of the EIDL loan agreement:

- Maintain “current and proper” records for the most recent five years until three years after your loan maturity or after the loan has been paid in full, whichever comes first.

Records include:

Financial and operating statements

-

- Insurance policies

- Tax returns and related filings

- Records of earnings or dividends distributed

- Records of compensation to owners or shareholders

- Allow the SBA to inspect or audit all books and records

- Allow the SBA to inspect or appraise any business assets

- Provide financial statements to the SBA within three months of the end of your fiscal year

- Pay for a review of financial statements by an independent public accountant, if requested by the SBA (this is included in our services to you).

- Allow all Federal, State, and municipal governments to provide the SBA with relevant documents if requested by the SBA

How do I maintain good records?

An accurate and up-to-date set of books will allow the SBA (and you!) to get a clear look at the financial health of your business, using financial documents such as your balance sheet and income statement.

You’ll need to track and categorize all your business expenses. Receipts and invoices should be digitally filed and recorded. It can take some time, but it’s well worth the effort to be able to see where your money is going and ensure you’ll be able to get the most of your eligible deductions come tax season.

Are my current records okay?

For SBA-ready books, you should have completed financials for the last five years of your business: a fully completed and accurate ledger of transactions, list of accounts, an income statement, and balance sheet.

That will put you in the best possible position if the SBA chooses to audit your business. Plus, preparing regular financial statements is a recommended best practice for understanding how your business is performing. These documents also allow your CPA or accountant to prepare an accurate tax return.

6-30-2020 The Department of the Treasury and the Internal Revenue Service (IRS) have announced that the 2019 tax filing deadline remains July 15, 2020.

Due to COVID-19, the original filing deadline and tax payment due date for 2019 was postponed from April 15, 2020, to July 15, 2020. With many states still under travel and work restrictions due to the pandemic, some taxpayers and tax professionals alike were hoping that the date might be extended.

Last week, Treasury Secretary Steven Mnuchin had not ruled out the possibility of pushing out the deadline, saying, “It’s something I’m thinking about.” He had indicated that he would continue to consider the idea as the date approaches.

But today’s announcement appears to rule out any additional changes. Individual taxpayers who cannot meet the July 15 due date can request an automatic extension of time to file. Keep in mind that the extension is a six-month extension from the original filing date of April 15, meaning that an extension will extend the time to file to October 15, 2020. It is not an extension from the extended due date.

If you can’t pay, help is available.

“The IRS understands that those affected by the coronavirus may not be able to pay their balances in full by July 15, but we have many payment options to help taxpayers,” said IRS Commissioner Chuck Rettig. “These easy-to-use payment options are available on IRS.gov, and most can be done automatically without reaching out to an IRS representative.”

Payment options are available on IRS.gov/payments to help taxpayers who can’t pay in full and some can offer taxpayers smaller penalties. That’s important since interest and late-payment penalties will continue to accrue on any unpaid taxes.

6-23-2020 The (Not Quite) Definitive Guide To Paycheck Protection Program Program Loan Forgiveness

6-23-2020 EIDL Loan Questions Answered

1. QUESTION: How do I get in touch with customer service phone support?

ANSWER: The highest level of official customer service is known as “tier 2” and can be reached by calling 1-800-659-2955 and asking for Tier 2.

They are unfortunately, a very limited means of support. They are able to check your application status and see the current “stage” and leave notes in your file, but unable to directly make any changes or escalate anything in a meaningful way.

Most are very nice and well meaning people but are usually poorly informed and often provided contradictory information between calls. The important thing to understand is that notes left by T2 do not actually notify a loan officer or anyone, they are simply waiting to be read if someone happens to open your file and takes the time to review the case notes. So if a T2 says they requested a change do not assume it was or will be made.

2. QUESTION: What are my chances of being approved for this loan? Can I know in advance?

ANSWER: The loan is relatively easy to get approval for by loan standards. The exact underwriting criteria the SBA is using was leaked by some helpful people and thus you can have a good understanding what your chances are.

Underwriters look for the following:-Minimum Credit Score of 570. They will pull from experian. Close to Vantage 3 model found on nav DOT com or TransUnion numbers on credit karma. They do NOT use FICO. Credit score is largest factor for approval for this loan and no exceptions are made for under 570.

-If economic injury was sustained based on formula described in QUESTION 4. If this is a negative number you will be auto declined. (SEE QUESTION 5) The SBA does not consider potential revenue lost or general expenses in the loan amount.

-Tax liens or tax issues are NOT a disqualifying factor or taken into consideration for COVID19 disaster.

-open bankruptcies = Declined. Closed OK.

-Arrest for felony < 5 years = Declined

-Arrest for misdemeanor < 5 years = Declined

-Sole proprietors with delinquent child support > 60 days = Declined

-Any business principals with 50% or more ownership with delinquent child support > 60 days = Declined

-All owners on application must be either US citizens or Permanent Residents. E-2 Investor visa is NOT eligible and any attempts to appeal or add a co-borrower who is a citizen or LPR will be unsuccessful. Corporations, Partnerships, and Limited Liability Entities (LLE): Alien-owned corporations, partnerships, and LLEs properly registered and licensed in the state where the disaster occurred are eligible. If any member, partner, or shareholder, owning 20 percent or more of the applicant business is in the USA they must be a qualified alien. If the alien resides outside the USA an exception may be made.3. QUESTION: I received a decline letter for “Business activity not eligible”. What can I do?

ANSWER: EIDL has a list of restricted business categories, if your type is NOT on this list and you still received this letter you may have been improperly classified.

The following applicants are not eligible for EIDL assistance.

7-Eleven Franchise Stores, despite what corp office says. (advance is OK)

Lending or Investment Concerns (except for real estate investments held for rental)

Multi-level Sales Distribution (Pyramid) Concerns c. Speculative Activities d. Non-profit Organizations that are not considered a Private Non-Profit

Consumer and Marketing Cooperatives. However, other cooperatives and small agricultural cooperatives meeting applicable size standards are eligible f. Not a small business concern (except for PNP of any size) g. Gambling Concerns. Concerns that derive more than one-third of their annual gross revenue from legal gambling activities.

Casinos, Racetracks, Etc. Businesses whose purpose for being is gambling (such as casinos, racetracks, poker parlors, etc.) are not eligible for EIDL assistance regardless of their ability to meet the one-third criteria established for otherwise eligible concerns.Loan packagers who derives more than one-third of their annual volume from the preparation of applications seeking financial assistance from SBA

Religious Organizations.

Political or Lobbying Concerns.

Pawn shops, when 50 percent or more of previous year’s income was derived 50 30 9 71 Effective Date: May 31, 2018 from interest

Real Estate Developers. Establishments primarily engaged in subdividing real property into lots and developing it for resale on their own account.

Life Insurance Companies.

Concerns Engaged in Illegal Activities (as defined by Federal guidelines). p. Government-owned concerns, except for businesses owned or controlled by a Native American tribe.

Concerns with Principals Incarcerated, on Parole or Probation: remain ineligible if the parole or probation is lifted solely because it is an impediment to obtaining a loan.

Concerns engaged in live performances of, or the Sale of Products, Services, of a Prurient Sexual Nature.

Businesses considered as hobbies.

Concerns Involved in Change in Ownership Situations: Concerns which had a substantial change of ownership (more than 50 percent) after the impending economic injury became apparent, and no contract for sale existed prior to that time are ineligible .

4. QUESTION: How is the loan amount calculated? How can I request a specific amount?

ANSWER: There is no way to request a specific amount, the eligible amount is calculated automatically by formula based on your inputs. There are three known formulas:

Standard Small Business: Revenue minus COGS divided by 2 minus advance, subject to maximum of 150K

Not for Profit: 6 months operating expenses year prior to 1/31/20Business that collects rental property income, your offer is calculated by lost rents due to the disaster, not the standard formula. If your offer is lower than expected you may have been wrongly classified into this formula.

Agricultural businesses: 6 months operating expenses year prior to 1/31/20

If the formula results in a negative number or less than your advance you will be declined for “ECONOMIC INJURY NOT SUSTAINED”

5. QUESTION: What is the maximum loan amount?

ANSWER: As of last update it is currently 150K cap. This will not change anytime soon and there will be no way to request more at present. The only way to avoid the cap is if your loan was already being obligated prior to the change by the SBA from 500K. If I hear anything new on this it will be updated here.

6. QUESTION: When will I get my portal invite?

ANSWER: Portal invites are a fully automated process and not strictly sequential but follow general group patterns. If you see someone that has a higher number than you get a portal invite it does NOT mean you were “passed over”.

Note: as of 5/30 there are a number of very early applications that are actually “stuck” in the credit pull stage (no portal invite yet, if you have the portal you do not have this issue) due to a glitch. If you have an application date of 3/29, 3/30, 3/31, or 4/01 (but no later) you may email me for information on how to get this resolved. Please be honest and accurate about your application date, I will know. If you app date is later and you still haven’t gotten your portal invite, I cannot help with this! I can’t stress that enough.

7. QUESTION: I finally got a portal invite and accepted and submitted an amount. My application says it is “processing”, now what?

ANSWER: This is when the actual loan process starts and underwriting begins. Your application will be assigned a loan officer for review using the criteria listed in question 2.

The exact process is as follows with the actual stages from start to finish. Keep in mind that once you accept in the portal a number of things are going on behind the scenes, which is why “processing” can take a great deal of time. Once you see a loan amount in your portal, this is NOT an approved offer. It is simply a potential amount you are eligible for based on the stated formula if you pass underwriting.

Initial Call Needed (credit not ran)

LO assigned and makes decision: Declined, Duplicate, Approved[The following takes place behind the scenes and will not reflect in your portal, but will still say “processing”]

Approved: T2 Rep can now see your loan is approved on their screen. This means the Loan Officer has approved the deal and it is now going to the Senior Loan Officer. If the SLO does not approve the deal then it will go to declined.

Obligating: SLO known as a “team leader” reviews the work of the first LO to ensure everything was done correctly. Once they sign off on the deal the loan is now fully approved. The loan is being sent to the E-Tran system to receive a loan number. The loan has not yet received a loan number from E-Tran while obligating. This is the most common phase where hang ups in “processing” can error called “error in obligating”. Usually due to small technical issues or errors in your information that need to be sorted.Obligated: A loan number from E-Tran has been obtained and now closing documents can be drafted and sent to the borrower. This is when your portal would change from “processing” to approved. There may be a delay between when your offer is obligated to when it actually shows approved. I have seen it happen in as fast as 10 minutes or as long as 12 hours. You can also see approved but not have docs available. Docs will not show up until you get an email with the approval. The delay on this can be a few hours or more.

Funding: Docs are signed and the loan is automatically moved to funding stage to have treasury issue an ACH. This happens very quickly and you should see the ACH sent right after with the funds arriving in 24-48 hours on banking days. **NOTE** Currently as of 6/10 we are seeing delays in funding of up to a week or even more, as it is very backed up in the queue.** At this point you can track the disbursement with your loan number from the docs using CAWEB to see if the ACH has been sent. See CAWEB question.

Funded: Process complete, funds are successfully in your bank account. Congrats

Note: The exception to this process is that some applications which are considered easy (based on unknown factors) to approve are subject to full automation and may go straight to approval bypassing the above steps. This only happens in rare cases.

You may also see a status that says, “On-Hold” Amount $0: This status typically is when your loan was temporarily declined and is still in the reconsideration department pending possible reconsideration approval.

8. QUESTION: I now understand that processing really means “underwriting”, but how long will it actually take? What is the normal amount of time?

ANSWER: The amount of time it is normal for your portal to say “processing” is highly variable as a hundred different factors are involved behind the scenes. As of 6/10 we are seeing extended delays in processing time and obligating stage specifically. The average we are seeing is around 14-16 days total in processing. If your application has been in underwriting for greater than 14 days it may merit investigate, but not necessarily indicate a problem with your chances of approval. Do NOT panic if it seems “stuck” with no communication from anyone. This is normal.

9. QUESTION: Does contacting my congressmen or senator actually work?

ANSWER: Yes, the SBA treats congressional inquiry very carefully and will flag and sometimes white glove your application. Often they will assign a special case worker during the process. The important thing is when your local congressional office reaches out they do NOT contact the local district SBA but this email:

focwcongressionalinquiries@sba.gov. This email is NOT for use by applicants but only official government purposes.

10. QUESTION: Help! I accidentally entered the wrong revenue or COGS on my application and my offer amount was lower than I expected, is it possible to change this?

ANSWER: Yes, but two factors are important:

You should NOT have already accepted an amount and submitted for processing in the portal. *If you already did see note below.

You have documentation to backup the changes such as Federal Tax Returns 2018 or 2019 or P&L Statements. Tax returns are strongly preferred if available.

****The important thing here is DO NOT accept the offer in the portal if you need to revise your numbers.****

*IF YOU HAVE ALREADY ACCEPTED THE OFFER: Call tier 2 support as soon as you possibly can and ask them to make the following note in your file: Loan Officer, DO NOT approve this file without calling me, the applicant, because my (revenue or COGS) figures are wrong. I have supporting docs to make the changes. Please contact me ASAP.11. QUESTION: I need to change my Rev or COGS and I already accepted an amount in the portal, Tier 2 told me to do it! Is it too late?